2023 Luxury Resale Report: How sustainability and the cost of living crisis influences consumer habits in the secondhand apparel market

Posted on

Presenting our 2023 Luxury Resale Report. To better understand consumer habits and secondhand shopping trends in the preloved luxury market, we conducted an online questionnaire survey and have obtained answers from a diverse demographic of female secondhand shoppers.

The survey consisted of questions that covered various aspects of the preloved luxury market, including consumer and seller behaviour, attitudes towards secondhand shopping, and factors influencing purchase decisions.

What's in the report?

1. Market OverviewMarket Overview

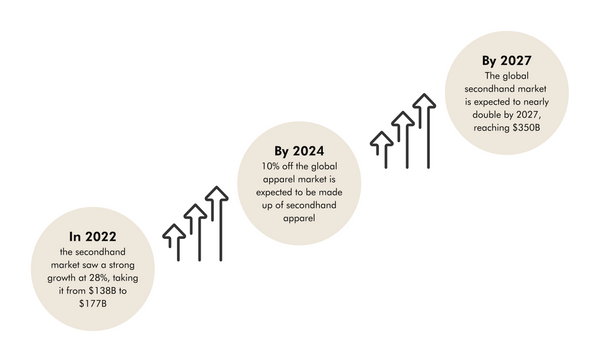

The global secondhand industry expected to grow 3x faster than the global apparel market

Luxury resale is growing 4x faster than overall luxury

The key drivers of the luxury resale market are:

- Circularity: The generational shift towards more sustainable shopping options

- Collectability: Accessing unique, hard-to-find and vintage designer bags, jewellery and watches

- Affordability: 42% of consumers in the UK have embraced circular fashion because it offers a new way to factor in the cost of living crisis

- Digital growth: Luxury resale market’s growth is primarily driven by digital platforms which currently account for 25-30% of the market and will continue to grow 20-30% per year

Access the full report here

Key takeaways and insights: Consumer & Seller habits

Affordability is the number one driver for consumers to shop secondhand designer goods, whilst sustainability and concern for the environment is only the third most important driver.

- 80% of respondents stated that price is the most important driver to shop secondhand

- 80% of respondents believe that shopping secondhand has a planet-positive impact, yet it is only the third most important driver, falling at 53%.

- 65% shop secondhand for the novelty factor: to access unique designer items

- According to thredUp, 46% of millennials and Gen Z say that they take the resale value of a product into consideration before buying, indicating that these shoppers see the resale market as an investment opportunity

Secondhand shopping is becoming increasingly popular as inflation persists and consumers factor in the cost of living.

- Luxury resale offers the opportunity to shop designer brands at a more accessible price point.

The majority of consumers are looking for preloved investment pieces when they shop secondhand i.e. Handbags and leather goods from true-luxury brands: Chanel, Prada, Louis Vuitton, Gucci & more.

- Statistics show that increasingly more shoppers are looking for good-quality everyday basics and wardrobe staples. i.e. secondhand designer shoes, tops, trousers, knitwear and jackets from Stella McCartney, The Row, Celine & more.

- An increasing need for everyday basics is emerging as the percentage of secondhand apparel increases in consumers' wardrobes

- According to The Ellen McArthur Foundation, resale apparels are expected to make up 11% of the average citizens wardrobe by 2027 and will nearly double to 18% by 2031.

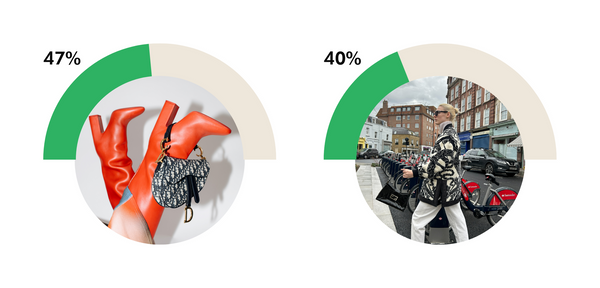

The majority of preloved luxury consumers shop secondhand once a month.

- 40% of respondents said they shop secondhand once a month, versus the 10% minority who shop secondhand once a week

- According to the Boston Consulting Group, 70% of consumers admit to taking better care of the products they purchase thanks to the resale market

- A lower rate of secondhand purchases indicates a shift towards sustainable consumption habits. Consumers for-go the high-consumption of fast fashion in favour of secondhand luxury goods that last.

Size & fit is the number one challenge consumers face shopping secondhand, whilst apathy towards wearing used clothing has significantly diminished.

- Resale needs repair: Circular fashion calls for collaboration with alteration and repair services

- Alterations and repair apps, enter the market as a the future calls for making fashion that already exists fit. Sit tight as more brands partner with start ups that offer a Deliveroo-like alteration services that tackle the issue of size and fit. Read more about what designer brands are doing to incorporate sustainable practices here.

The preloved luxury resale market is experiencing the most growth digitally

- Via preloved luxury online shops that provide an easy UX shopping experience, although statistics show that in-person secondhand designer shops continue to deliver value. Read our blog on the best secondhand shops and independent boutiques in London here.

-

Value is found from shopping in-person, but market growth is online: According to BCG X Altagamma, Digital native (Gen Z and Millenial) consumers account for nearly 2/3s of incremental secondhand spend, of which 80% use online channels to trade.

Convenience is key for secondhand sellers: A hassle-free resale process is more important than high commission or listing prices.

- Price motivates secondhand sales, but convenience is key for luxury sellers: Before higher commission, the priority is a seamless start to sale process and quick to respond customer care.

- As the market grows, preloved luxury resellers offer increasingly personalized sell services.

- 76% of respondents have sold their items via secondhand resellers. Sell designer items online and in the UK here.

How sustainability and the cost of living crisis has influenced consumer behaviour

61% of Gen Z and Millennials consider themselves eco-conscious and sustainability focused and 80% of respondents said that they are aware of the planet-positive impact of extending the life cycle of goods.

Yet, according to our survey, sustainability was only the #3 most important driver to shop secondhand.

Where consumers have had to face a drastic increase in inflation over the last two years, environmental issues are a low priority for many as affordability hits close to home. Consumers have been finding new channels to spend less, of which many lead to secondhand shopping and is in part, largely behind the growth of the market. Affluent and average spending power consumers turn to preloved luxury resellers to shop for luxury goods that were more accessible at retail price prior to the cost of living crisis.

As economic uncertainty persists alongside the boom of the secondhand market, it is likely that these behavioural changes are here to stay for the long-run for the many benefits of shopping secondhand that precede affordability.

Methodology, sources and infographics included in the full report.

Access the full report here

Where can I buy and sell secondhand designer goods online and in the UK?

Written by

Thalia Guarnieri

Published at

-

-

- Choosing a selection results in a full page refresh.

- Press the space key then arrow keys to make a selection.